Healthcare Regulatory Changes Impact Analysis

2025 Policy Outlook

By: Drew Campbell & Byron Campbell, Capitol Insights

March 2025

TABLE OF CONTENTS

- Introduction

- Federal Regulatory Changes

- 2.1 CMS Reimbursement Changes

- 2.2 Price Transparency Requirements

- 2.3 Telehealth Regulations

- Texas State Regulatory Landscape

- 3.1 Medicaid Transformation Initiatives

- 3.2 Provider Licensure and Scope of Practice

- 3.3 Health Data Privacy and Security

- Impact Analysis by Provider Type

- 4.1 Hospitals and Health Systems

- 4.2 Physician Practices

- 4.3 Post-Acute and Long-Term Care

- Compliance Strategies

- 5.1 Implementation Timelines

- 5.2 Resource Requirements

- 5.3 Compliance Best Practices

- Conclusion and Recommendations

1. Introduction

The healthcare regulatory landscape in Texas continues to evolve rapidly, shaped by both federal policy shifts and state-level initiatives. This analysis examines the most significant regulatory changes anticipated or implemented in 2024-2025 and their implications for healthcare organizations operating in Texas.

Healthcare providers face a complex matrix of compliance requirements, operational adjustments, and strategic considerations as they navigate these evolving regulations. This document aims to provide a comprehensive overview and actionable insights to help organizations prepare effectively for these changes.

Key themes in the current regulatory environment include:

- Continued focus on price transparency and consumer empowerment

- Expansion and standardization of telehealth services

- Evolution of value-based care models

- Enhanced data privacy and security requirements

- Changes to provider scope of practice and licensure

- Implementation of new Medicaid transformation initiatives

Understanding these regulatory shifts is essential for strategic planning, compliance management, and operational decision-making across all healthcare sectors.

2. Federal Regulatory Changes

Federal regulatory actions continue to have profound implications for healthcare delivery and financing in Texas. The following subsections detail the most significant federal changes affecting Texas healthcare organizations.

2.1 CMS Reimbursement Changes

The Centers for Medicare and Medicaid Services (CMS) has implemented several reimbursement changes that will impact provider operations and financial performance:

- Medicare Physician Fee Schedule Updates: The 2025 fee schedule includes a 3.5% conversion factor reduction, significantly impacting physician practice revenue. Specialties most affected include radiology, anesthesiology, and surgery.

- Hospital Outpatient Prospective Payment System (OPPS) Changes: CMS has expanded site-neutral payment policies, reducing payment differentials between hospital outpatient departments and physician offices for certain services.

- Alternative Payment Model Adjustments: New risk adjustment methodologies in ACOs and bundled payment programs have been implemented, changing financial incentives for participating providers.

- Rural Emergency Hospital (REH) Program Implementation: This new Medicare provider type allows critical access hospitals and small rural hospitals to convert to REH status, with associated payment modifications.

| Payment Model |

Key Changes |

Implementation Date |

Provider Impact |

| Medicare Physician Fee Schedule |

3.5% conversion factor reduction |

January 1, 2025 |

High - Estimated 5-8% revenue impact for most specialties |

| Hospital OPPS |

Expanded site-neutral payments |

January 1, 2025 |

Moderate - Affects hospital outpatient department revenue |

| ACO REACH Model |

New risk adjustment methodology |

January 1, 2025 |

Variable - Depends on patient population risk profile |

| Rural Emergency Hospital Program |

New provider type with specific payment structure |

Ongoing |

High for converting facilities - Potential viability lifeline |

Texas providers should conduct financial modeling to understand the specific impact of these changes on their organizations and develop mitigation strategies where significant negative effects are projected.

2.2 Price Transparency Requirements

Price transparency regulations continue to expand, with enhanced enforcement mechanisms now in place:

- Hospital Price Transparency Rule Enforcement: CMS has increased penalty amounts for non-compliance and implemented a more rigorous audit process. Texas hospitals have seen variable compliance rates, with larger systems generally achieving higher compliance scores.

- No Surprises Act Implementation: The independent dispute resolution process continues to evolve, with new guidance on qualifying payment amounts and information requirements. Texas providers have reported challenges with the IDR process, citing administrative burden and unfavorable resolutions.

- Transparency in Coverage Requirements: Health plans must now provide consumer-friendly tools for price comparison, affecting provider-payer contracting dynamics. These requirements create both challenges and opportunities for Texas providers in contractual negotiations.

- Pharmacy Benefit Manager Transparency: New regulations require PBMs to disclose rebates and pricing structures, with implications for healthcare organizations with in-house pharmacies or pharmacy partnerships.

Compliance with these transparency requirements demands significant administrative resources but also creates opportunities for providers who can effectively communicate their value proposition in an increasingly transparent marketplace.

2.3 Telehealth Regulations

Telehealth regulations have undergone substantial changes following the COVID-19 public health emergency:

- Medicare Telehealth Extension: Congress has extended certain Medicare telehealth flexibilities through 2025, including expanded eligible services and provider types. This extension provides short-term certainty but leaves long-term telehealth strategy uncertain for Texas providers.

- Audio-Only Services: CMS has made permanent coverage for specific audio-only services, particularly beneficial for rural Texas communities with limited broadband access.

- Remote Patient Monitoring: Expanded coverage for remote monitoring services has been implemented, with new device and service requirements. Texas providers can leverage these changes to enhance chronic care management programs.

- Interstate Licensure Considerations: Federal efforts to address interstate licensure barriers continue, though state-level requirements remain primary. The Texas Medical Board's approach to out-of-state providers continues to evolve in this context.

Texas healthcare organizations should develop comprehensive telehealth strategies that account for both the current regulatory landscape and potential future changes, particularly regarding interstate practice and reimbursement parity requirements.

3. Texas State Regulatory Landscape

State-level regulatory initiatives in Texas significantly impact healthcare delivery and compliance requirements, often intersecting with and building upon federal frameworks.

Texas Medicaid continues to evolve through several key initiatives:

- 1115 Waiver Implementation: The renewed Texas 1115 Healthcare Transformation Waiver includes revised program parameters for Delivery System Reform Incentive Payment (DSRIP) successor programs. These changes affect hospital and provider funding, particularly for safety-net providers serving uninsured and underinsured populations.

- Directed Payment Programs: Texas Medicaid has implemented revised quality metrics and participation requirements for programs such as the Comprehensive Hospital Increased Reimbursement Program (CHIRP) and Texas Incentives for Physicians and Professional Services (TIPPS). These programs provide critical supplemental funding for participating providers.

- Managed Care Organization Oversight: Enhanced accountability measures for MCOs have been implemented, including new network adequacy requirements and performance metrics. These changes aim to improve access and quality in the Medicaid managed care system.

- Eligibility Verification Processes: Following the end of continuous enrollment provisions, Texas has implemented new eligibility verification procedures affecting provider administrative processes and patient coverage status. Providers should implement robust eligibility verification protocols to mitigate coverage gaps.

Healthcare organizations participating in Texas Medicaid programs need to adapt to these evolving requirements while developing strategies to maintain financial sustainability within this changing landscape.

3.2 Provider Licensure and Scope of Practice

Several notable changes to provider licensure and scope of practice have been implemented or are under consideration:

- Advanced Practice Registered Nurse Authority: Legislative changes have modified supervision requirements for APRNs in certain practice settings, affecting team-based care models and potentially increasing access in underserved areas.

- Physician Assistant Practice Requirements: Revised delegation and supervision protocols have been implemented, changing practice dynamics particularly in rural and underserved areas where access challenges persist.

- Pharmacy Practice Expansion: Pharmacist authority for certain services, including vaccinations and point-of-care testing, has been expanded, creating opportunities for innovative care delivery models.

- Behavioral Health Provider Certification: New certification requirements and pathways for behavioral health professionals aim to address workforce shortages in mental health services.

- Facility Licensing Changes: Updated requirements for ambulatory surgery centers, freestanding emergency departments, and other facilities affect operational compliance and potential market entry barriers.

These evolving scope of practice regulations require healthcare organizations to reassess their workforce models and consider how changing provider roles may affect their service delivery strategies.

3.3 Health Data Privacy and Security

Texas has enhanced its approach to health data protection through several regulatory initiatives:

- Texas Medical Records Privacy Act Enforcement: Increased enforcement actions under the Texas Medical Records Privacy Act reflect heightened attention to patient privacy protections that exceed federal HIPAA requirements in certain aspects.

- Health Information Exchange Requirements: New standards for participation in health information exchanges affect interoperability strategies and data sharing practices across the Texas healthcare ecosystem.

- Cybersecurity Requirements: Healthcare-specific cybersecurity standards have been implemented, including mandatory reporting of certain security incidents and minimum security control requirements.

- Consumer Health Data Protections: New protections for consumer-generated health data not covered by HIPAA have implications for providers engaged in remote monitoring, mobile health applications, and other consumer-facing digital health initiatives.

Healthcare organizations must ensure their privacy and security programs address both federal and Texas-specific requirements, with particular attention to areas where state regulations exceed federal standards.

4. Impact Analysis by Provider Type

The cumulative effect of federal and state regulatory changes varies significantly by provider type, with different sectors of the healthcare industry facing distinct challenges and opportunities.

4.1 Hospitals and Health Systems

Texas hospitals and health systems face a complex regulatory landscape with several high-impact changes:

- Financial Impact: The combined effect of site-neutral payment policies, price transparency requirements, and changes to supplemental payment programs creates significant financial pressure, particularly for safety-net and rural facilities.

- Operational Requirements: New compliance obligations related to price transparency, surprise billing, and quality reporting increase administrative burden and technology requirements.

- Strategic Implications: Regulatory trends accelerate the shift to outpatient care, value-based payment models, and consumer-oriented service delivery, requiring strategic adaptations.

- Scale Advantage: Larger systems generally have more resources to adapt to regulatory changes, potentially accelerating consolidation trends in the Texas hospital market.

Successful adaptation requires hospitals to develop integrated regulatory response strategies that align compliance activities with broader strategic and operational initiatives.

4.2 Physician Practices

Independent and employed physician practices face distinct regulatory challenges:

- Financial Pressures: Medicare Physician Fee Schedule reductions, combined with inflation and labor costs, create significant financial sustainability challenges for independent practices.

- Administrative Burden: Compliance with expanding quality reporting, price transparency, and prior authorization requirements strains administrative capacity, particularly for smaller practices.

- Practice Model Evolution: Regulatory incentives increasingly favor alternative payment models and integrated care delivery, influencing practice structure decisions.

- Technology Requirements: Information blocking, interoperability, and telehealth regulations necessitate technology investments that may be challenging for smaller organizations.

Practices should evaluate their capacity to meet evolving regulatory requirements and consider structural adaptations, such as clinically integrated networks or management services organizations, to enhance compliance capabilities while preserving clinical autonomy.

4.3 Post-Acute and Long-Term Care

The post-acute and long-term care sector faces a particularly complex regulatory environment following the COVID-19 pandemic:

- Quality Measurement Changes: Updated Skilled Nursing Facility Quality Reporting Program and Value-Based Purchasing Program metrics significantly impact reimbursement and require adapted quality improvement approaches.

- Staffing Requirements: New minimum staffing standards for nursing facilities affect operational costs and workforce strategies in a challenging labor market.

- Infection Control Standards: Enhanced infection prevention and control requirements necessitate program development and staff training investments.

- Home-Based Care Expansion: Regulatory changes facilitating home-based care alternatives create both competitive challenges and partnership opportunities for facility-based providers.

Post-acute and long-term care organizations should implement robust regulatory monitoring systems and develop flexible operational models that can adapt to rapidly evolving requirements.

5. Compliance Strategies

Effective regulatory compliance requires a structured approach that encompasses implementation planning, resource allocation, and operational integration.

5.1 Implementation Timelines

Key regulatory changes follow different implementation schedules, requiring careful planning and prioritization:

| Regulatory Change |

Initial Effective Date |

Full Implementation Deadline |

Enforcement Approach |

| CMS Reimbursement Changes |

January 1, 2025 |

January 1, 2025 |

Immediate application to claims |

| Hospital Price Transparency |

January 1, 2021 |

Already in effect |

Progressive penalties for non-compliance |

| No Surprises Act |

January 1, 2022 |

Already in effect |

Complaint-driven investigation process |

| Information Blocking |

April 5, 2021 |

Already in effect |

Penalties being implemented in phases |

| Texas Medicaid Directed Payment Programs |

September 1, 2024 |

September 1, 2024 |

Participation requirements enforced through payment |

| New Facility Licensing Requirements |

Varies by facility type |

Varies by facility type |

Typically enforced at license renewal |

Organizations should develop comprehensive regulatory calendars that track implementation deadlines and align compliance activities with internal operational planning cycles.

5.2 Resource Requirements

Regulatory compliance demands various resource investments, which should be planned and budgeted accordingly:

- Technology Infrastructure: Regulatory requirements increasingly necessitate technology solutions for data reporting, consumer price transparency tools, telehealth delivery, interoperability, and security controls.

- Staffing Considerations: Specialized compliance personnel may be required, along with training for clinical and administrative staff on new requirements. Larger organizations may need dedicated regulatory affairs teams.

- External Expertise: Complex regulatory changes often require specialized legal, consulting, or technical support for effective implementation, particularly for smaller organizations with limited internal resources.

- Operational Process Development: New workflows, documentation requirements, and quality assurance processes typically need development and implementation to ensure sustainable compliance.

Healthcare organizations should conduct detailed resource assessments for each major regulatory change and consider the cumulative impact of multiple simultaneous compliance initiatives on organizational capacity.

5.3 Compliance Best Practices

Several best practices can enhance regulatory compliance effectiveness:

- Integrated Compliance Management: Develop a centralized approach to compliance management that aligns regulatory requirements with operational processes and strategic objectives.

- Proactive Monitoring: Implement systematic monitoring of regulatory developments at both federal and state levels to identify changes early in the process.

- Cross-Functional Teams: Establish cross-functional implementation teams that include clinical, operational, financial, and technical perspectives for comprehensive compliance planning.

- Documentation Systems: Maintain robust documentation of compliance activities, including policy development, staff training, and monitoring processes.

- Regular Assessments: Conduct periodic compliance assessments to identify gaps and ensure ongoing adherence to regulatory requirements.

- Industry Engagement: Participate in trade associations, advocacy groups, and regulatory comment processes to stay informed and potentially influence regulatory development.

Effective compliance programs balance technical adherence to regulatory requirements with practical operational implementation, recognizing that sustainable compliance must be integrated into day-to-day activities.

6. Conclusion and Recommendations

The healthcare regulatory landscape in Texas continues to evolve rapidly, presenting both challenges and opportunities for healthcare organizations. Several key themes emerge from this analysis:

- Accelerating Transformation: Regulatory changes are accelerating the transformation of healthcare delivery and financing models, particularly regarding value-based care, telehealth, and consumer empowerment.

- Compliance Complexity: The overlapping and sometimes conflicting nature of federal and state regulations creates significant compliance challenges, particularly for organizations operating across multiple care settings.

- Financial Implications: Many regulatory changes have substantial financial implications that must be incorporated into strategic and operational planning.

- Operational Integration: Effective regulatory response requires integration of compliance activities with core operational processes rather than treating them as separate functions.

- Opportunity Identification: Organizations that effectively navigate the regulatory landscape can identify strategic opportunities within compliance requirements.

Based on this analysis, we recommend that Texas healthcare organizations consider the following approaches:

Strategic Recommendations

1. Develop a Comprehensive Regulatory Strategy

Rather than addressing each regulatory change in isolation, organizations should develop an integrated approach that:

- Identifies interdependencies between regulatory requirements

- Prioritizes initiatives based on implementation deadlines and organizational impact

- Aligns compliance activities with broader strategic objectives

- Centralizes regulatory intelligence gathering and analysis

- Establishes clear governance structures for regulatory response

2. Invest in Strategic Compliance Capabilities

Forward-looking organizations should build capabilities that transform compliance from a cost center to a strategic asset:

- Develop data analytics capabilities to monitor compliance performance

- Implement technology solutions that address multiple regulatory requirements

- Establish proactive regulatory intelligence functions

- Create compliance training programs that emphasize the "why" not just the "what"

- Build regulatory expertise as a core organizational competency

3. Adopt a Consumer-Centric Compliance Approach

Regulatory trends increasingly emphasize consumer empowerment, suggesting organizations should:

- View price transparency as a market differentiation opportunity

- Develop consumer-friendly tools that exceed minimum requirements

- Integrate compliance with patient experience initiatives

- Communicate compliance activities in consumer-friendly terms

- Leverage regulatory change to enhance consumer trust and engagement

4. Implement Risk-Based Prioritization

With limited resources, organizations should adopt risk-based approaches that:

- Assess compliance risks based on both probability and impact

- Prioritize high-risk areas for immediate attention

- Develop appropriate mitigation strategies for moderate-risk areas

- Establish monitoring systems for lower-risk requirements

- Regularly reassess risk profiles as regulatory landscapes evolve

5. Pursue Collaborative Compliance Models

The complexity of the regulatory environment suggests value in collaborative approaches:

- Participate in industry associations and working groups

- Explore shared compliance services for smaller organizations

- Engage in collaborative technology development

- Share best practices within appropriate legal boundaries

- Develop coordinated advocacy positions on key regulatory issues

6. Integrate Regulatory Planning with Business Strategy

The most successful organizations will view regulatory change as a strategic consideration by:

- Including regulatory analysis in strategic planning processes

- Considering regulatory implications in service line development

- Evaluating regulatory trends in market entry decisions

- Incorporating regulatory costs in financial forecasting

- Identifying competitive advantages in regulatory compliance excellence

7. Prepare for Emerging Regulatory Focus Areas

Organizations should position themselves for likely future regulatory developments:

- Health equity measurement and reporting requirements

- Environmental sustainability standards for healthcare facilities

- Artificial intelligence and algorithmic transparency regulations

- Social determinants of health integration requirements

- Cross-sector data sharing frameworks and standards

Implementation Roadmap

To execute these recommendations effectively, we suggest a phased implementation approach:

Phase 1: Assessment and Prioritization (1-3 months)

- Conduct comprehensive regulatory impact assessment

- Develop prioritization framework based on deadlines and organizational impact

- Establish governance structure for regulatory response

- Identify resource requirements and capability gaps

- Create integrated implementation timeline

Phase 2: Capability Development (3-6 months)

- Implement regulatory intelligence and monitoring systems

- Develop cross-functional implementation teams

- Enhance technology infrastructure for compliance management

- Establish training and communication frameworks

- Create compliance documentation and reporting systems

Phase 3: Implementation and Integration (6-12 months)

- Execute high-priority compliance initiatives

- Integrate compliance activities with operational processes

- Develop performance metrics and monitoring systems

- Implement regular assessment and improvement mechanisms

- Establish ongoing regulatory change management processes

Phase 4: Strategic Optimization (12+ months)

- Identify opportunities for competitive advantage through compliance excellence

- Develop consumer-facing compliance communications

- Implement advanced analytics for compliance performance

- Establish continuous improvement mechanisms

- Create future-focused regulatory planning capabilities

By implementing these recommendations, healthcare organizations can transform their approach to regulatory compliance from a reactive necessity to a strategic capability that enhances overall organizational performance while effectively managing risk in an increasingly complex environment.

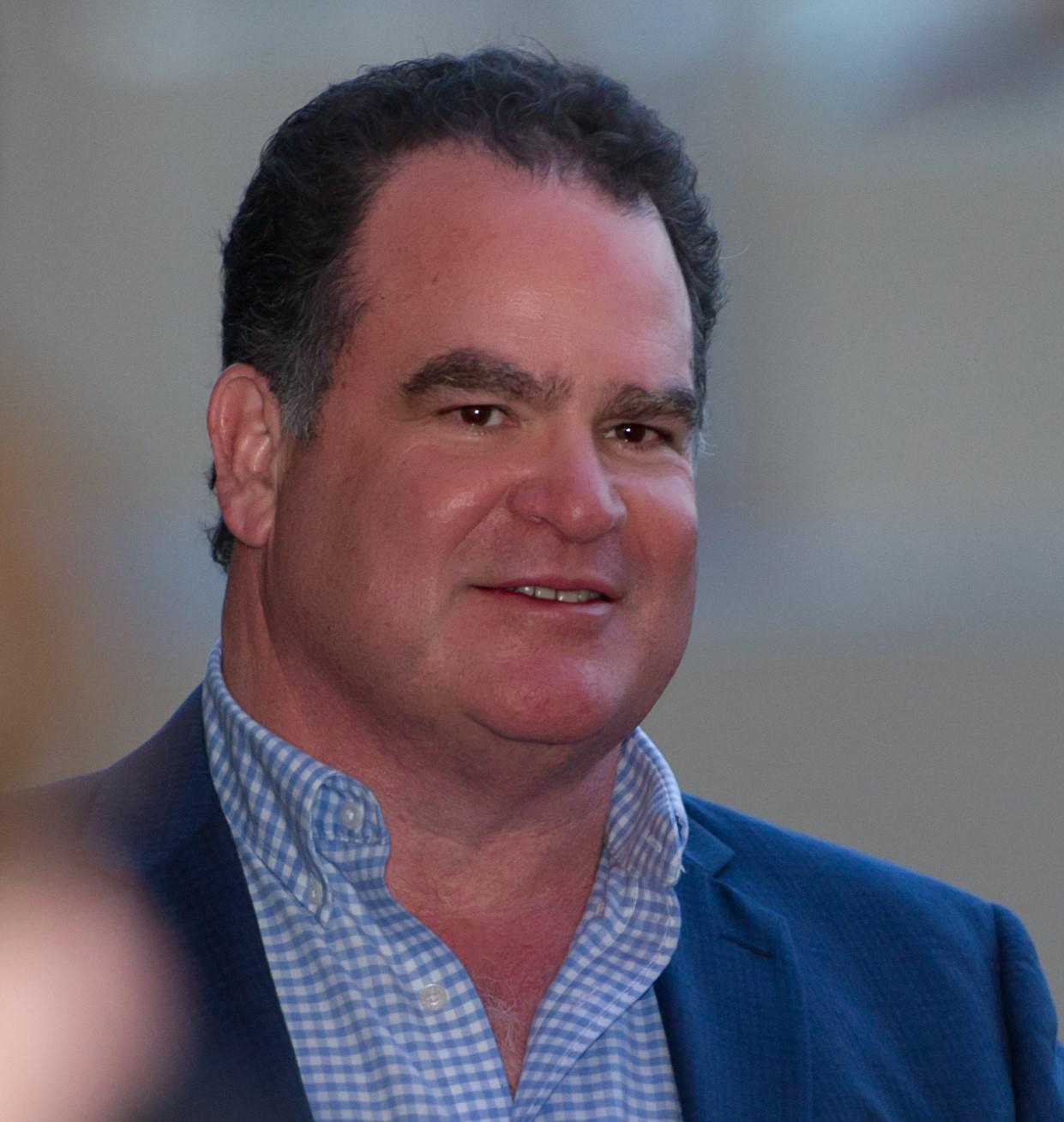

Drew Campbell is a Senior Partner at Capitol Insights, a Texas government relations firm specializing in healthcare, transportation, and infrastructure policy. With over 40 years of experience in Texas legislative and regulatory affairs, Drew has guided hundreds of healthcare organizations through complex regulatory transitions.

Byron Campbell is a Senior Partner at Capitol Insights with expertise in healthcare policy, digital health regulation, and strategic government relations. His background in both public and private sectors provides unique insight into the evolving regulatory landscape facing healthcare providers.

Capitol Insights provides strategic government relations consulting, regulatory analysis, and advocacy services for healthcare organizations throughout Texas. For more information, visit www.capitol-insights.com.